By Anuj Puri

By Anuj Puri, Chairman & Country Head, JLL India

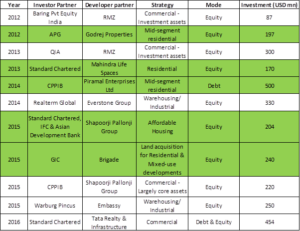

Partnerships, often between investors and developers, create a pool of money that is available for all projects matching a specific set of criteria without having to go through the time-consuming approval process. These partnerships are also called platforms. Over the past two-three years, India has seen creation of various such equity or debt platforms.

So far, more than USD 2.8 billion worth of platforms are already in place, largely equity-based and showing a shift in focus to residential, especially the affordable and mid-housing projects. This model of investment is expected to grow further in the future.

Why equity kept away from residential realty and how this may change for the better

Why equity kept away from residential realty and how this may change for the better

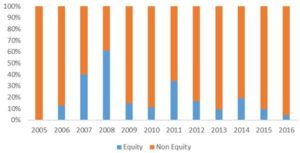

From a historic high seen in 2009, when the share of private equity (PE) inflows into residential real estate peaked to 60% of the overall pie, it has gradually reduced to 10% in 2016. This 10% figure is same as the investment split seen in 2006, which was the first time equity’s interest, was tracked into the residential asset class. PE investment was entirely focused on the commercial asset class in the initial few years.

Post the global financial crisis (GFC) in 2008, equity infusion has been largely restricted to office projects closer to completion. Various reasons led to equity investors shying away from investing in residential projects. Among them, a major reason was lack of uniformity in rules followed by the states. Other reasons included project delays, limited legal options for investors, and inadequate transparency and corporate governance.

However, through the implementation of RERA (Real Estate [Regulation and Development] Act) and demonetisation, the government has worked towards removing all major inconsistencies in the system. While the real estate business has currently taken a step back due to these, it will set a very strong foundation for long-term growth. Equity investments at such times can work extremely well for long-term investors.

However, through the implementation of RERA (Real Estate [Regulation and Development] Act) and demonetisation, the government has worked towards removing all major inconsistencies in the system. While the real estate business has currently taken a step back due to these, it will set a very strong foundation for long-term growth. Equity investments at such times can work extremely well for long-term investors.

With limited cash outflows allowed until completion of the project (thanks to the RERA) and lower demand for properties (thanks to demonetisation and the Benami Property Act), developers will remain under pressure. Money circulation will slow down and the new cash flow generation will reduce further.

With limited scope for further leverage, developers will be open to providing good entry points to the long-term equity investors. While a few equity-related risks would continue, attractive entry points will provide a higher margin of safety to equity investors. The table above illustrates how a few investors have already realised this and taken steps accordingly.

Top-five criteria for equity investors in choosing the right partners for creation of platforms:

· High focus on corporate governance

· Proven corporate track record

· Alignment of investment and operational philosophy among the partners

· Skin in the game (equity infusion by the developer)

· Potential for long-term successful partnership.